Via’s IPO Closes Above Initial Valuation: Tech Startup Specializing in Transit Software Raises $492.9M, Nears Profitability

On Friday, the initial public offering (IPO) of transit software startup Via saw shares open below the company’s IPO price, but recovered slightly by closing day, ending just over $49 per share. This valued the company at approximately $3.9 billion upon its first trading day.

Initially filing confidentially for an IPO in July, Via priced its shares at $46 each, raising a total of $492.9 million. After a brief dip to $44 when trading commenced on Friday afternoon, the stock recovered to close slightly above the initial offering price.

The company raised approximately $328 million in its IPO, with existing shareholders selling an additional $164 million worth of shares, bringing the total deal size to nearly $493 million.

Upon the successful completion of the IPO, Via CEO Daniel Ramot expressed satisfaction and gratitude towards the company’s team, partners, and investors for making this milestone possible.

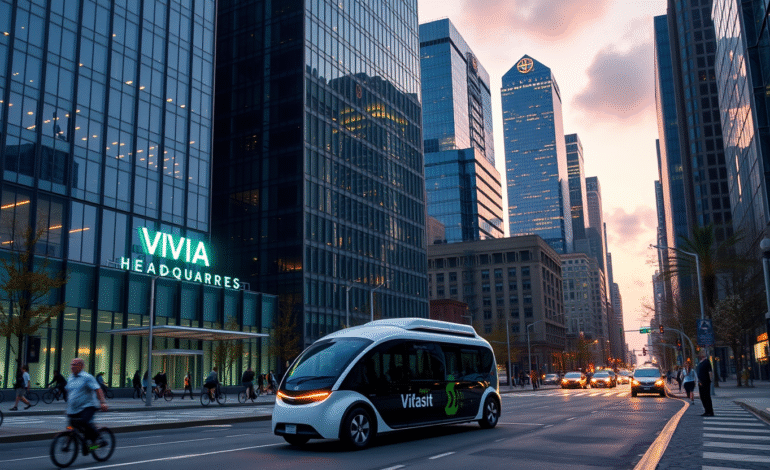

Founded in 2012, Via initially deployed Via-branded shuttles that users could hail. Over time, the company improved its on-demand routing algorithm, which uses real-time data to route microtransit shuttles to where they’re needed most. Today, this technology forms the core of Via’s business, which is sold to 689 cities and transit agencies to power their microtransit services.

Ramot revealed that the company intends to utilize the proceeds from the IPO for growth, sales, and marketing efforts. He also hinted at potential acquisitions in the future, citing Via’s previous acquisitions of Remix for bus planning in 2021 and CityMapper for journey planning in 2023 as examples.

Via reported a revenue increase of roughly 30% year-over-year, with projections indicating that the company expects to earn around $429 million in revenue by 2025. For the first six months of 2025, Via recorded $205.7 million in revenue, but the company is still operating at a loss, albeit a shrinking one. The first six months of 2025 ended with a loss of $37.5 million, down from $50.4 million the previous year.

While Via remains close to profitability, Ramot did not provide specific projections regarding when the company might become profitable. He also emphasized that government customers can sustain a lucrative business, especially considering that Via’s technology primarily benefits riders of microtransit and paratransit systems, which cater to low-income individuals, people with disabilities, and students. Ramot expressed satisfaction at seeing investors support this demographic.