A Trillion-Dollar Race: Top Tech Giants Invest Heavily in AI Infrastructure for Future Growth

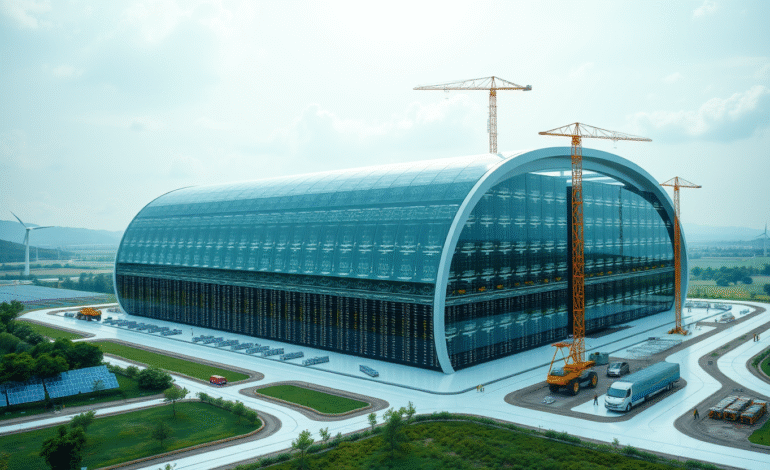

The escalating demand for AI technology has triggered a parallel race to develop the necessary infrastructure to support it. Recent estimates suggest that up to $4 trillion will be spent globally on AI infrastructure by the end of this decade, with a significant portion coming from AI companies themselves. This surge in spending is putting immense pressure on power grids and pushing the construction industry to its limits.

Below, we provide an overview of major AI infrastructure projects led by prominent tech giants like Meta, Oracle, Microsoft, Google, and OpenAI. This list will be updated as the trend continues and investment figures rise even higher.

Microsoft’s investment in AI infrastructure began with a $1 billion commitment to OpenAI in 2019. The deal made Microsoft the exclusive cloud provider for OpenAI, and as AI model training demands grew more intense, a substantial portion of Microsoft’s investment shifted towards Azure cloud credits. By 2023, Microsoft’s investment had grown close to $14 billion, positioning itself for substantial returns when OpenAI transitions into a for-profit company.

Recently, however, the partnership between Microsoft and OpenAI has evolved. In January 2023, OpenAI announced it would no longer be exclusively using Microsoft’s cloud services, opting instead to grant Microsoft a right of first refusal on future infrastructure demands while pursuing other providers if Azure is unable to meet their needs. Additionally, Microsoft has been exploring alternative foundation models for its AI products and establishing more independence from the AI sector.

OpenAI’s successful collaboration with Microsoft has set a precedent in the AI industry, leading other AI service providers to align with specific cloud providers. Anthropic, for example, has secured an $8 billion investment from Amazon, which involved kernel-level modifications on Amazon’s hardware specifically tailored for AI training. Google Cloud has also signed smaller AI companies like Lovable and Windsurf as primary computing partners without any direct investment. Moreover, OpenAI received a $100 billion investment from Nvidia in September 2022, enabling it to purchase more of the company’s GPUs.

In June 2025, Oracle announced a confidential $30 billion cloud services deal with an unnamed partner—a figure surpassing the company’s total cloud revenues for the entire previous fiscal year. In October 2025, OpenAI was revealed as the partner, solidifying Oracle’s position alongside Google as one of OpenAI’s hosting partners. The news sent Oracle’s stock soaring.

Oracle secured another major deal in September 2027, agreeing to a five-year, $300 billion compute power agreement set to commence in 2027. Oracle’s stock price rose even further, temporarily making founder Larry Ellison the world’s richest individual. The sheer size of the deal is impressive: OpenAI does not have $300 billion to spend, implying substantial growth potential for both companies and a great deal of optimism.

For companies like Meta that already possess significant legacy infrastructure, the investment strategy is more complex but equally expensive. Mark Zuckerberg announced in 2021 that Meta planned to invest $600 billion in U.S. infrastructure by the end of 2028. In the first half of 2025 alone, Meta spent over $30 billion more than the previous year, with much of this increase attributed to growing AI ambitions.

Some of this spending is directed towards large cloud contracts, such as a recent $10 billion deal with Google Cloud. However, a significant portion is being channeled into two massive new data centers: Hyperion in Louisiana and Prometheus in Ohio. The 2,250-acre Hyperion site in Louisiana, estimated to cost $10 billion, will provide around 5 gigawatts of computing power. Notably, the site includes an arrangement with a local nuclear power plant to accommodate increased energy requirements. The smaller Ohio site, called Prometheus, is expected to come online in 2026, relying on natural gas for power.

This significant buildout has environmental implications. Elon Musk’s xAI built its own hybrid data center and power generation plant in South Memphis, Tennessee. The plant has rapidly become one of the county’s leading emitters of smog-producing chemicals, due in part to a series of natural gas turbines that experts claim violate the Clean Air Act.

In January 2021, former President Trump announced a joint venture between SoftBank, OpenAI, and Oracle, aiming to invest $500 billion in building AI infrastructure within the United States. Dubbed “Stargate,” the project was met with high expectations—Trump calling it “the largest AI infrastructure project in history”—with Sam Altman of OpenAI concurring, stating, “I think this will be the most important project of this era.”

In essence, SoftBank is providing the financing for the project, while Oracle handles the construction, with input from OpenAI. Trump promised to remove any regulatory obstacles that could slow down the build. However, doubts emerged from the beginning, including from Elon Musk and Altman’s business rival, who questioned the project’s availability of funds.

As hype surrounding the project has dwindled, progress has been sluggish. In August 2022, Bloomberg reported that the partners were struggling to reach a consensus. Nonetheless, construction on eight data centers in Abilene, Texas, is underway, with completion of the final building expected by the end of 2026.