Breakthrough Energy Announces Most Global Cohort Yet of Climate Tech Startups, Focusing on International Solutions to Global Waste and Hydrogen Economy

A climate tech organization founded by Bill Gates, Breakthrough Energy, is adapting to the global economic uncertainties and shifting policy priorities by reevaluating some of its long-term investments. Despite these changes, the group continues to support startup investments and its flagship program, the Breakthrough Energy Fellows.

The newest cohort of fellows will be announced today, with a total of 45 individuals from 22 different startups. This diverse group showcases the evolving nature of the program, reflecting both its own data analysis and global uncertainties.

“This cohort is our most globally distributed to date, with half of the teams based outside the U.S.,” said Ashley Grosh, Vice President at Breakthrough Energy. The selection process involved screening over 1,500 applications and referrals, making it more competitive than admission to top universities worldwide.

The United States is home to eleven teams, while six are based in Asia, with the remainder spread across Canada, Germany, the U.K., and South Africa. The expansion of the fellowship program’s reach can be attributed to a new hub established in Singapore in August 2024, in partnership with Temasek, the country’s investment fund, and Enterprise Singapore, a government agency.

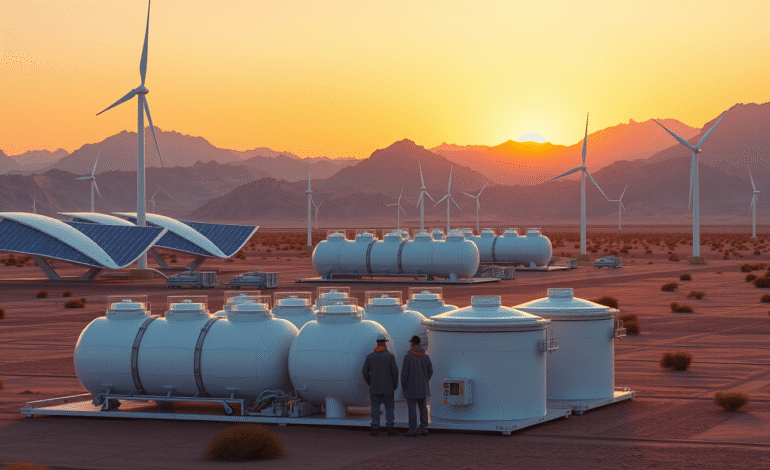

The international focus is not solely geographical; it also acknowledges that climate change, being a global issue, necessitates solutions from various regions of the world. For instance, several cohort members are working on hydrogen technology, an area of significant interest in Asia due to its potential for a hydrogen economy and the region’s emphasis on circularity – recycling materials back to their original form or better.

The new cohort will also feature startups focusing on critical minerals, agriculture, and grid modernization.

In addition to its global focus, Breakthrough Energy Fellows have revamped their curriculum. After observing and receiving feedback from previous cohorts, they are now encouraging fellows to consider the economic aspects of their technology development early and frequently. Using techno-economic analysis, they work with business experts to determine if their ideas can find a viable product-market fit. If not, they are guided towards pivoting.

“We’ve noticed many companies coming in with one specific focus, only to pivot later,” Grosh explained. “They become more investor-attractive once we help them through that pivot and validate it.”

Grosh reported that nearly all teams from the previous four cohorts have secured follow-on funding, and one, Holocene, has already been acquired. “This is a significant achievement for us,” she said.